Improving Your Financial Resilience

Regaining financial stability, achieving financial independence and peace of mind can be possible.

Knowledge is empowering

When people who are experiencing gambling related problems have a better understanding about the nature of gambling and the related issues, they are in a more powerful position to begin to make the changes needed to reduce the harms they are experiencing.

Money management is an important part of this process to reduce financial harms.

Money and Gambling

One of the reasons people find gambling difficult to resist is because they learn to associate money with gambling. Money triggers an irresistible urge to gamble, often fuelled by thoughts of winning money.

When the person tells themselves and believes that they will win money, this makes gambling difficult to resist, despite the lack of available money.

This strongly held belief diminishes the capacity for rational thinking and increases the urges and likelihood of engagement in gambling.

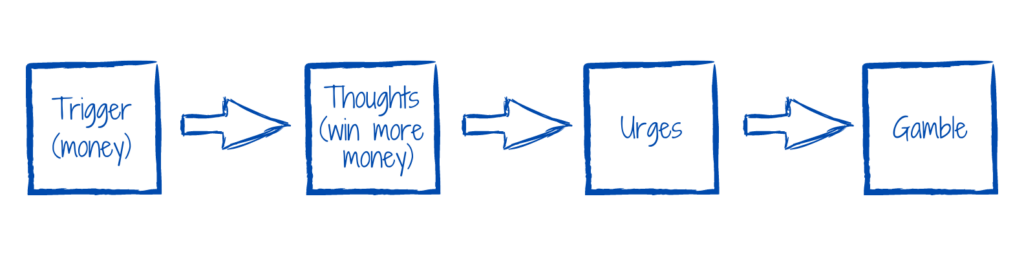

The automatic process can be seen in a simple diagram below:

Managing urges – not having access to money is the key!

Without access to money, gambling will be easier to resist and the urge can then slowly subside. Once the urge subsides, the rational part of the gambler’s brain will take control again. Once rational thoughts have returned, you will be less likely to gamble.

For example, once the urge subsides you can think rationally about the availability of money for gambling that is really needed to pay the rent for the week.

Once you have experienced the urge passing without gambling, it will give you the confidence to manage this each time you notice an urge to gamble.

It is important to continue to let the urge to gamble pass each time you notice an urge is triggered. Over time, the urge will then lose its power and your thoughts will become clearer about your decision to gamble.

Keeping Your Money Safe is Important

Give yourself the best chance of not gambling by keeping your money safe and secure from gambling.

Many of our clients who come for help admit that one of the reasons it is difficult to resist gambling is because money has become like monopoly or token money. For example, one client described how money lost its value:

“It didn’t feel like real money, it just felt

like tokens or something, so before I

knew it, my money was gone”

[SAIGHS client]

It is easier to resist gambling if you have an effective plan in place to keep your money safe when the temptation to gamble becomes difficult to resist. Limiting and controlling your access to cash for a short time can be an effective way to stop the gambling cycle.

Here are some simple strategies to get you started:

- Seek support, tell family and friends you trust what you are doing and ask them not to lend you money

- Protect your property and assets

- Use Visa Gift Cards – for example that can be purchased at a post office. These provide a handy way to purchase items without having direct access to cash or credit cards

- Purchase Coles/Woolworths gift cards for daily needs

- Take Banking Apps off your smartphone

- Cancel cash withdrawals on your credit card

- Pay as many bills as you can when you are paid

- Consider paying some bills in advance

- Ask someone you trust to pay bills for you before you access your pay

- Ask someone you trust to hold money for you and have a plan about how you will manage your money. For example, when you need to buy items

- Leave all access to money at home when you are going into risky situations

- Lower daily withdrawal limit on your accounts

- Talk to your bank about ways to avoid and restrict your money for gambling. Some banks now allow customers to block gambling transactions and may be able to ban the use of gambling services on your credit card

- Some people find a locked money box is a good way to keep cash safe – if they don’t have the key

- We can refer people for financial counselling to help with gambling-related money problems

Money management doesn’t have to be forever

If you commit to a treatment program with SAIGHS and eliminate your urges to gamble, your thinking will become clearer, and money will have value.

When you have completed the treatment program and can see that the urge to gamble is no longer a risk, your clinician will work with you to reintroduce money back into your life.

For example, clients provided positive quotes about their recovery:

“Money has value now – I don’t have the desire to gamble when I have money. I have more important things to spend my money on now”.

Counselling alone is often not helpful in changing the way the brain responds to money and other gambling triggers. To be fully in control, you need the psychological treatment program provided by SAIGHS to break these connections.

If you want money to have value and be free of the temptation to gamble, call us now for a chat and see how you can get started.

Please note that we are not a financial institution or financial advisers. For specific advice, please contact a registered financial adviser or we can put you in contact with a free gambling help service financial counsellor.